We enable businesses to accelerate their growth by offering tailored revenue advances & leveraging innovative tax-saving strategies for immediate reinvestment, ensuring sustainable & scalable expansion.

Explore our website. We help business of all sizes. Watch our interactive presentation right here.

SERVICES TO HELP YOUR BOTTON LINE:

We offer multiple services to help your financial situation now and in the future (we help your bottom line!)

Use these savings strategies to reinvest and expand your business!

Explore by clicking on the tiles.

(Must Have A Tax Liability of $50k+)

STRATEGIC TAX ELIMINATION

FACTS:

Without replacing your current CPA, we give you access to Advanced Tax Strategies that the ultra-wealthy use to pay these low rates. They do it, why shouldn't you?

We either find

substantial tax savings beyond what your current CPA/Tax person has implemented, or we can't charge you, it's our Guarantee. You've got nothing to lose and 10's of thousands (or more) to gain.

*Proven Tax Strategies Plus Audit Insurance!

RESEARCH & DEVELOPMENT CREDITS

The Research and Development (R&D) Tax Credit remains one of the best opportunities for businesses to substantially reduce their

tax liability.

For what amounts to their daily activities, companies from a wide range of industries can qualify for federal and state

tax savings high enough to allow companies to hire new employees, invest in new products and grow operations.

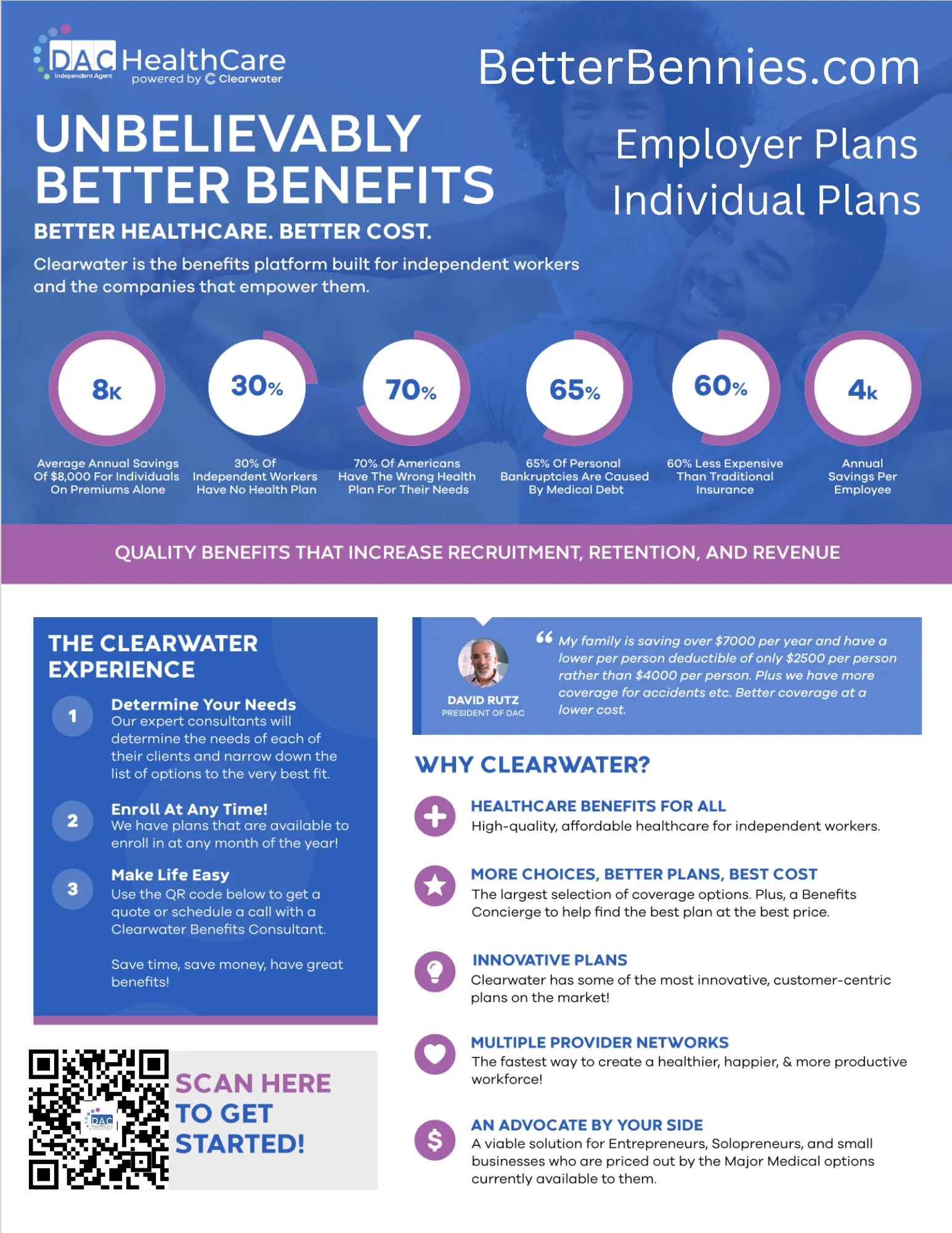

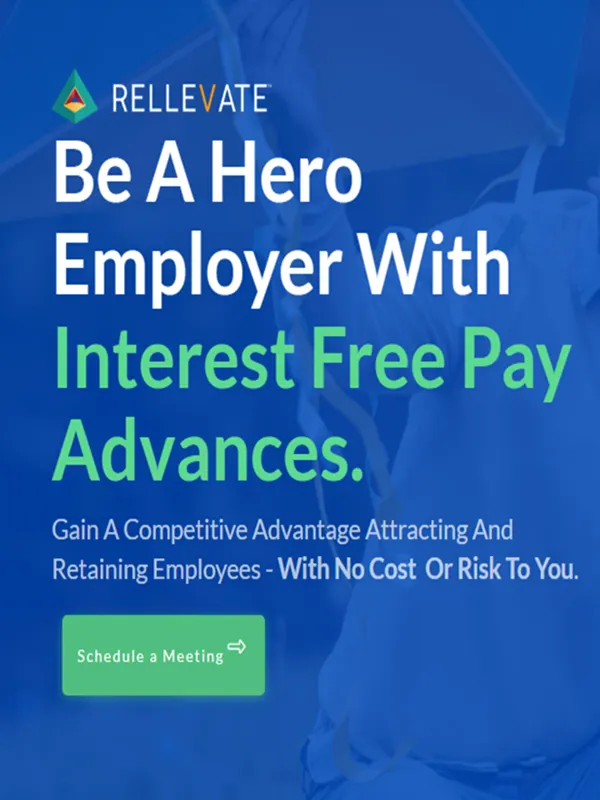

HEALTH BENEFITS

Access the best possible benefits for your workforce.

You'll see real benefits to your business in return!

Quality Benefits for Companies of all sizes

Your organization now has access to some of the most innovative plans on the market and dedicated consultants who provide insight, education, and solutions regardless of your company’s size.

TOP NOTCH CPAs

Maximize your refund. We help navigate the complexities of tax preparation and planning.

Maximize Your Return, Minimize Your Stress.

Our team of certified professionals specializes in maximizing returns and minimizing liabilities, ensuring a stress-free tax experience with personalized attention and the latest tax insights.

BREAK THE LANGUAGE BARRIER

Stop losing clients and your audience in less than 20 minutes.

Translation is our business. Period.

The entire global community can access your brand, content and services in their own language.

The entire global community can access your brand, content and services in their own language.

GROW YOUR PRACTICE

Help patients get the treatments they need with smaller monthly payments

Remove cost as a barrier to care by offering fast, simple financing to your patients.

1- Lower Your Merchant Fees

Save up to 50% on your merchant fees.

2- Get Paid Upfront

Receive full payment in 2-3 business days. Easily improve your cash flow

3- Stop Chasing Payments

Cherry handles loan repayment directly with your patient and takes on the financial risk.

Visa/Mastercard $5.5B SETTLEMENT

Deadline is 2/4/2025

If Your Business Accepted Visa and/or Mastercard Between 2004 - 2019, You May Be Eligible to Claim Your Share of the $5.54 Billion Visa/Mastercard Settlement.

Imagine this—Visa and Mastercard have been overcharging businesses like yours for years, and now they’re handing out checks to make up for it. Yes, you read that right! There’s a$5.5billion settlement on the table, and your business could get a slice of it—no strings attached (well, maybe a tiny string or two)

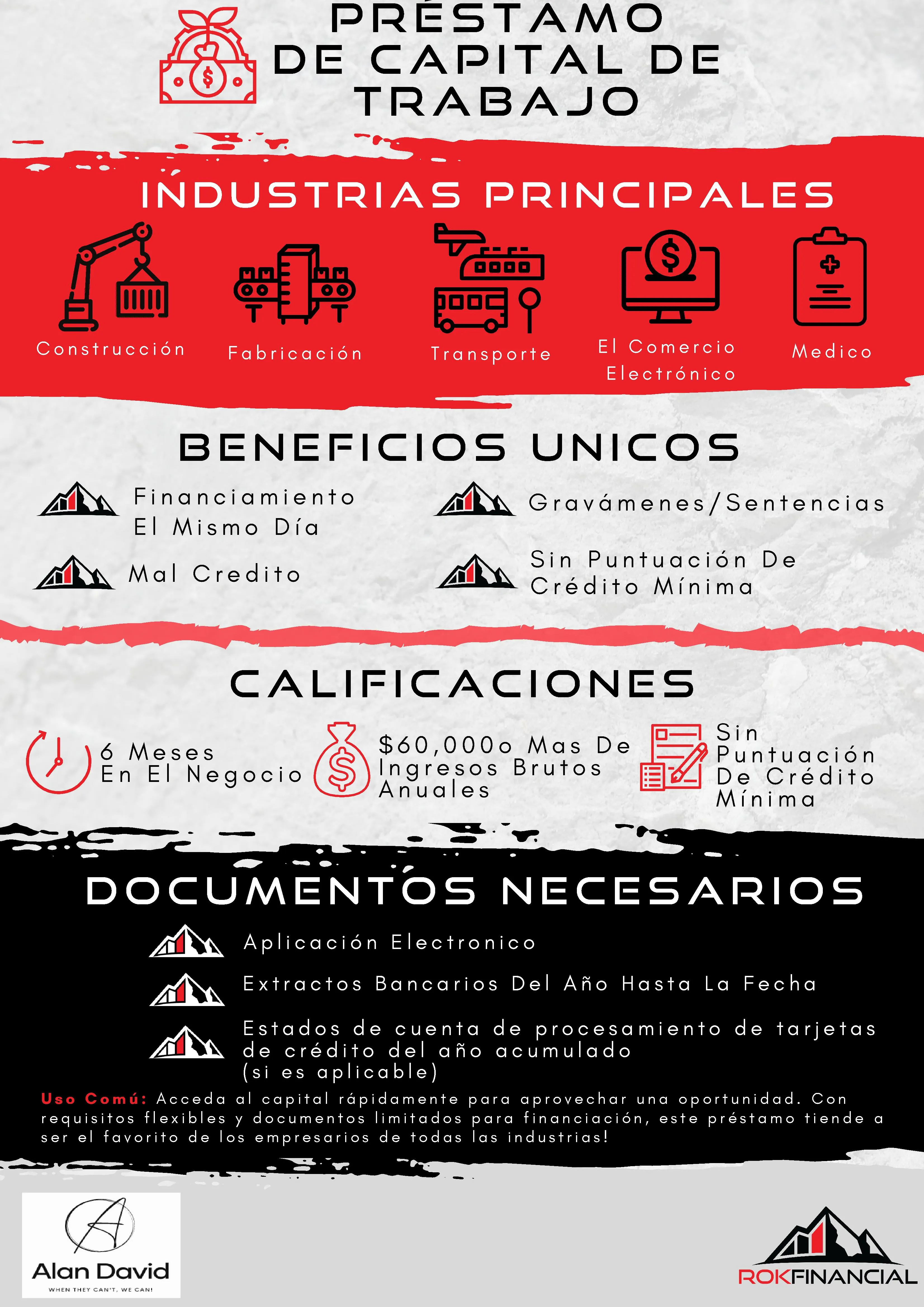

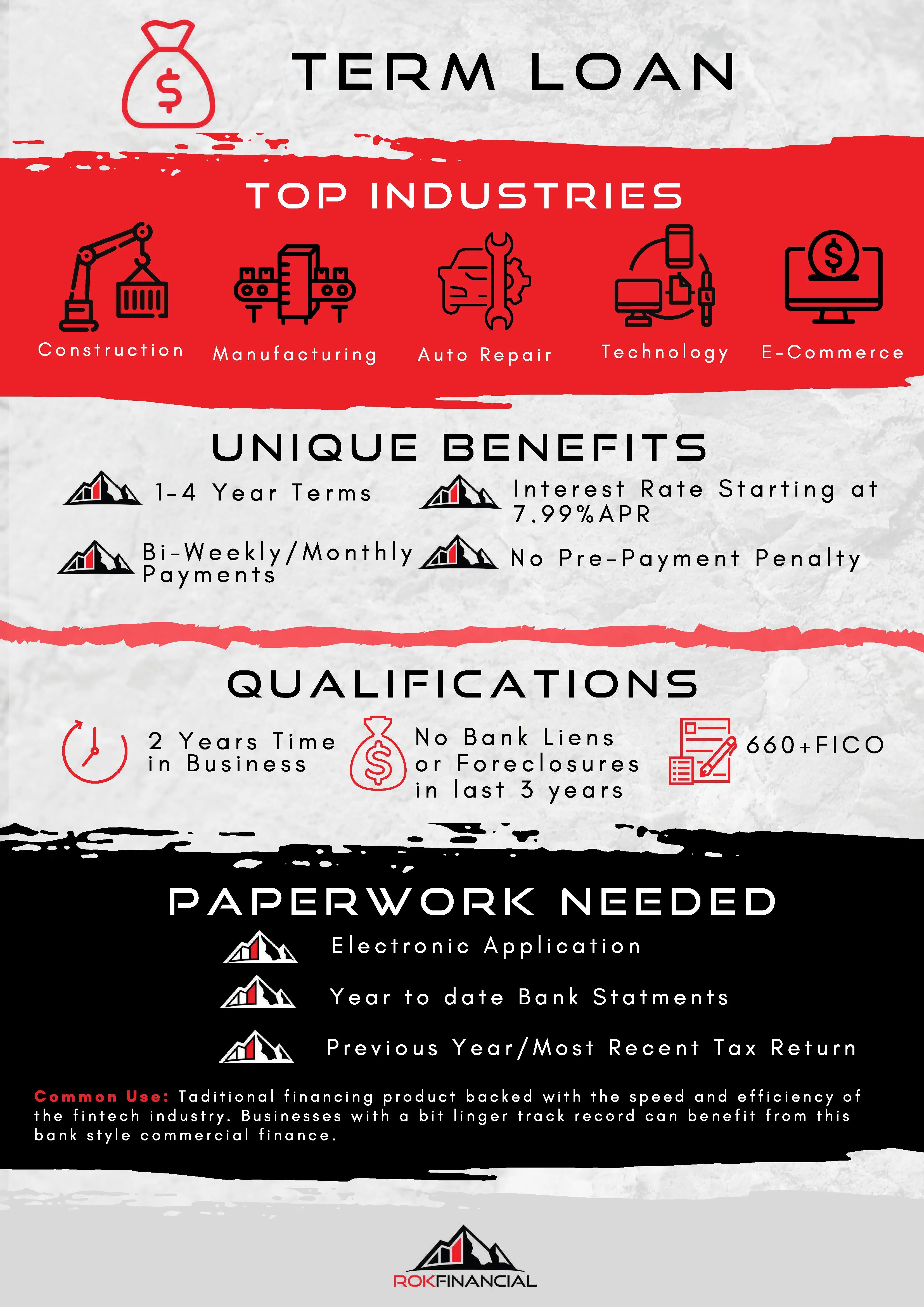

REVENUE BASED FUNDING IS AVAILABLE

We specialize in providing revenue-based working capital to small businesses, enabling them to meet their short-term financial needs and seize growth opportunities. We understand that traditional financing options may not always be accessible or suitable for small businesses, which is why we offer this alternative funding solution.

Our revenue-based working capital program works by assessing the revenue streams and financial performance of a small business. Rather than relying solely on credit scores or collateral, we analyze the historical and projected revenue of the business to determine its eligibility for funding. This approach allows us to provide financing to businesses that may have limited credit history or lack significant assets.

FUNDING/FINANCE OPPORTUNITIES

Explore these opportunities by clicking on the tiles.

About our company

Unlocking Small Business Growth with Revenue-Based Working Capital

In today's dynamic business landscape, small enterprises often find themselves in need of financial support to seize growth opportunities. Traditional financing options may not always be accessible, leaving small business owners in search of alternative funding solutions. At AlanDavid.us, we specialize in providing revenue-based working capital to small businesses, enabling them to meet their short-term financial needs and unlock their full potential for expansion.

Tailored Financing Solutions

Our revenue-based working capital program goes beyond conventional lending methods. We assess the revenue streams and financial performance of small businesses to determine their eligibility for funding. Unlike traditional lenders who rely solely on credit scores and collateral, we take a unique approach.

Eligibility Without Limitations

We understand that many small businesses have limited credit histories or lack significant assets. Our program offers a lifeline to such entrepreneurs. Small businesses can receive a lump sum of working capital, which can be utilized for a variety of purposes:

Purchasing Inventory: Stock up for growth.

Expanding Marketing Efforts: Reach a broader audience.

Hiring Additional Staff: Build a strong team.

Managing Cash Flow: Weather seasonal fluctuations.

Repayment Aligned with Success

Repaying the working capital is designed to align with the success of your business. Instead of fixed monthly payments, we tie the repayment to your business's revenue. A percentage of future sales is allocated towards repayment, providing flexibility during lean periods.

Personalized Financial Support

Every business is unique, and we understand that. That's why we offer personalized financing solutions tailored to meet the specific needs and circumstances of each client. Our team of financial experts works closely with small business owners to assess their requirements, determine the appropriate funding amount, and establish a repayment plan that aligns with their revenue projections. Unlock the full potential of your small business with revenue-based working capital from AlanDavid.us. We are your partner in growth and success.

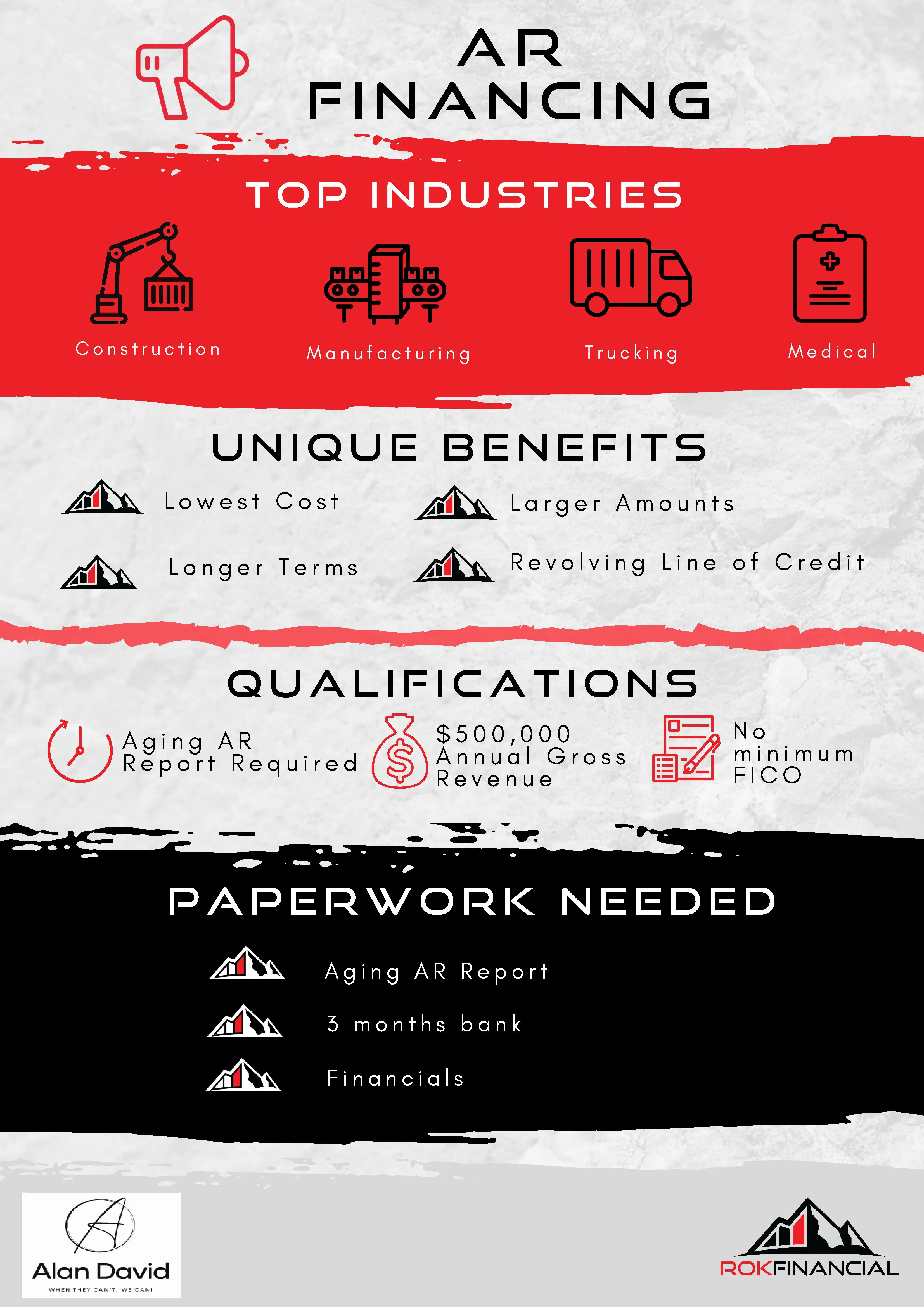

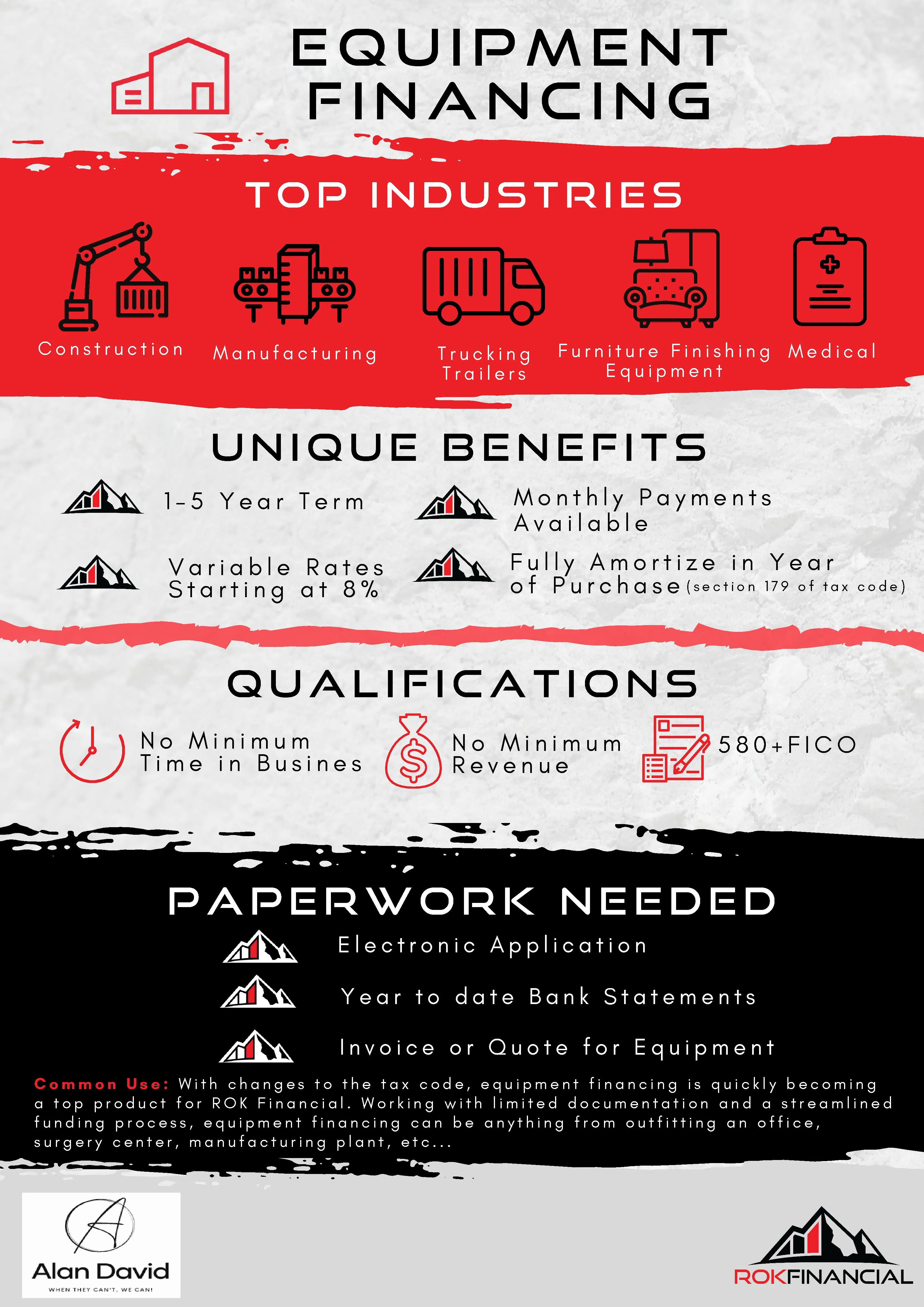

Our Product line also includes:

Accounts Receivable Financing, Asset Based Lending, Asset Based Loans, Business Line of Credit, Business Loans, CannaBusiness Financing, Commercial Mortgage Financing, Equipment Financing, Fix n Flip Loans, Franchise Financing, Merchant Cash Advance, Purchase Order Financing, Revenue Based Financing, ROK LOC, ROK Prime (working capital) SBA Loans, Small Business Loans, Startup Funding, Subordinated Debt, Term Loan, and more.

GET STARTED WITH REVENUE BASED FINANCING CLICK HERE.

GET STARTED WITH OTHER FINANCING CLICK HERE.

© 2025 AlanDavid.us. All Rights Reserved.